Overview

Your assets, managed to excel

Our exit strategy focuses on maximizing returns through strategic sales via private & public invites or asset-level sales to institutional investors, HNIs & family offices, leveraging demand for modern warehouses. We identify optimal exit points based on market conditions, ensuring value realization while aligning with long-term industry trends.

~40% Capital

returned to Fund 1 investors

2 Exits

delivered before time, seamlessly

Approach

Comprehensive strategy for sustained success

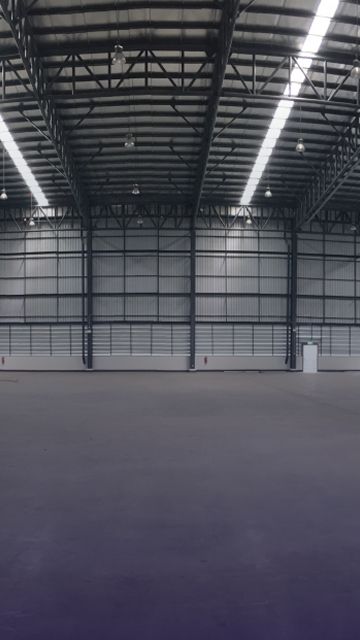

Successful Exits

Landmark exits in logistics

NEWS AND INSIGHTS

Perspectives that matter

Contact

Drive superior value from your assets

Your Relationship with Us:

Explore our integrated approaches

Spearheading new-age solutions

Raise Capital

We raise capital, tapping discretionary domestic & international sources to expand our footprint through high-impact, sustainable investments.

Buy Assets

When acquiring land, we prioritise location, connectivity, access, and scalability to align with our clients’ long-term logistics and fulfilment strategies.

Lease Assets

We build lasting partnerships through transparent, streamlined leasing — delivering smooth experiences that earn trust.